Background

Lloyds Banking Group has an ambition to reduce carbon emissions financed through the group to net zero by 2050 or sooner. This is in line with the UK Government’s 2050 net zero target.

One key target to meet this ambition is for Lloyds Banking Group’s residential mortgage portfolio to achieve a 41% reduction of financed emissions intensity by 2030 from a 2020 baseline.

The project

Lloyds Banking Group commissioned us to support this work by providing enhanced housing stock data, scenario modelling and analysis services.

The project involved:

- Benchmarking key attributes and energy efficiency characteristics of homes in Lloyds Banking Group’s mortgage book.

- Assessing the potential costs and savings of different building retrofit scenarios to improve SAP scores and energy efficiency and reduce carbon emissions and fuel bills.

- Identifying opportunities and challenges for cost-effective home improvements across the housing stock.

- Providing tailored insight to support with views and recommendations on future decarbonisation efforts.

Results

The report and dashboard will provide Lloyds Banking Group with some of the tools to complement its own in-house data. This will allow users within the group to interrogate housing stock characteristics, retrofit potential and tailor insight driven strategies for homes and their customers.

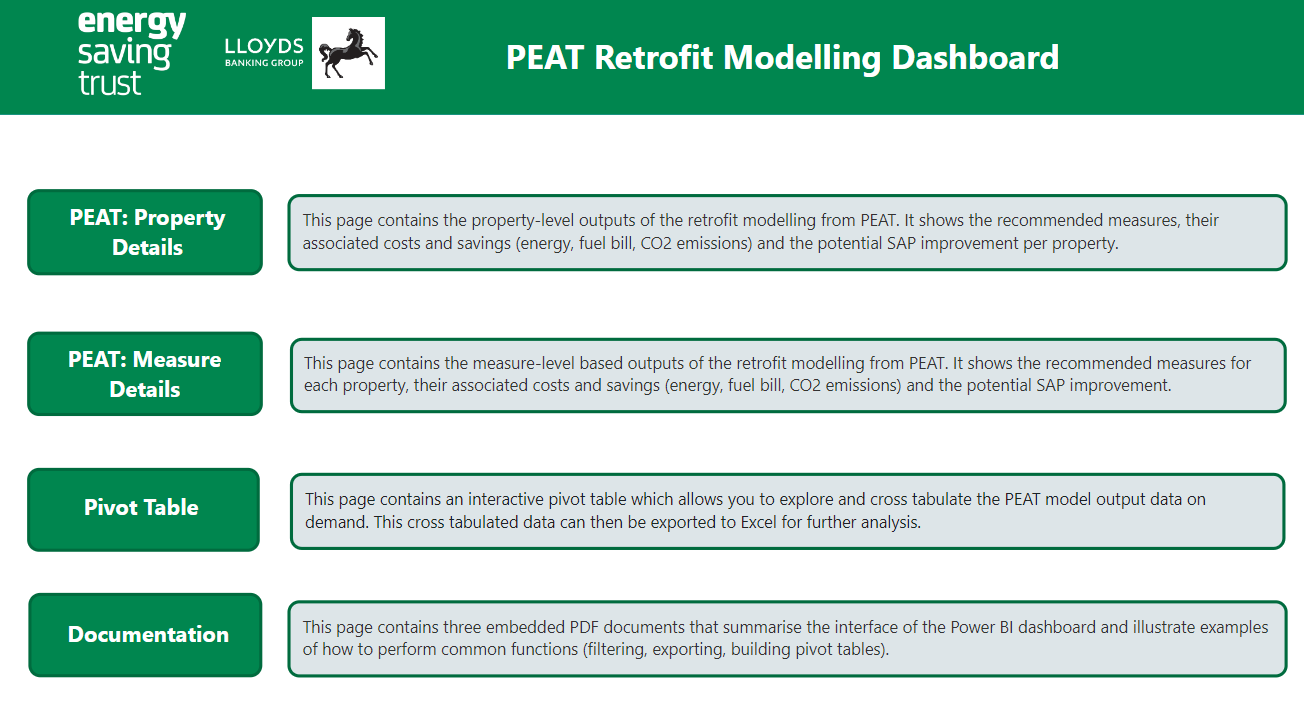

The data and retrofit modelling are also integrated into a Power BI dashboard. This allows Lloyds Banking Group to explore this data in real time by making the underlying data more accessible.

Lloyds Banking Group received a decarbonisation report that compares the costs and savings of two key retrofit pathways:

- Raising all homes to EPC band C.

- Pursuing net zero carbon emissions through deep retrofitting of homes.

The reports outline key challenges and opportunities, tailored to the homes in Lloyds Banking Group’s mortgage book. It also provides recommendations to guide ongoing strategy.

Amy Brown, homes sustainability at Lloyds Banking Group says of the project:

“Decarbonisation strategy is not a one-size-fits-all approach, especially when your customers and their homes are spread across the United Kingdom. The PEAT modelling work that Energy Saving Trust completed allowed us to build potential retrofit scenarios for our mortgage book to better understand the UK’s transition to net zero. Detailed outputs from the work allowed us to further analyse what retrofit transition plans might look like for our customers, the measures they may select and the potential associated costs.”

Sean Lemon, senior manager – data & digital at Energy Saving Trust says:

“We were delighted to assist the UK’s largest residential mortgage lender Lloyds Banking Group in evaluating the carbon footprint and energy efficiency potential of the homes they finance. Alongside a suite of existing Energy Saving Trust advice tools, the insights from this analysis will enable Lloyds Banking Group to further tailor its support to homeowners. We look forward to continuing our ongoing collaboration with Lloyds Banking Group, making a meaningful impact in decarbonising homes, promoting energy efficiency and helping homeowners take informed steps to save on their energy bills.”